On Wednesday, India’s lower house of parliament faced a second consecutive day of suspended proceedings due to disruptions caused by lawmakers. These lawmakers are calling for a discussion regarding the U.S. indictment of billionaire Gautam Adani. Meanwhile, shares of companies within his group recovered some of their earlier losses.

Last week, U.S. authorities leveled severe accusations against Adani, his nephew and executive director Sagar Adani, as well as Vneet S. Jaain, the managing director of Adani Green (ADNA.NS). They allegedly participated in a scheme involving $265 million in bribes to secure power supply contracts in India while misleading investors in the United States.

The conglomerate, which operates across various sectors, including ports and energy, has dismissed the allegations as “baseless” and has pledged to pursue “all possible legal recourse.”

The Congress party and other opposition factions in India have leveled serious allegations against Prime Minister Narendra Modi and his Bharatiya Janata Party (BJP), claiming they are protecting Adani and obstructing investigations into his activities. The ruling party has firmly rejected these allegations.

For the second consecutive day, Parliament proceedings faced disruption as Members of Parliament vocally expressed their demands for a discussion regarding the allegations against Adani, continuing the tumultuous atmosphere since the winter session commenced this week.

Rahul Gandhi, a prominent figure in Congress and known for his outspoken criticism of Adani, has called for the arrest of Gautam Adani.

“The individual has been indicted in the United States, and the government is providing him with protection,” Gandhi stated to reporters outside parliament.

The government has yet to state the indictment, while the ruling BJP has sought to distance itself from the ongoing controversy.

A spokesperson for the BJP stated that there was no obligation to defend Gautam Adani, emphasizing that the party does not oppose industrialists but views them as collaborators in the nation’s development initiatives.

“Let him defend himself,” stated spokesperson Gopal Krishna Agarwal on Tuesday, emphasizing that the law would proceed accordingly in case of wrongdoing.

On Wednesday, Adani Green announced that Gautam Adani had been charged in the United States for purported violations of securities law, which could result in potential fines. However, it was noted that he has not been charged under the U.S. Foreign Corrupt Practices Act.

In a stock exchange filing, Adani Green disclosed that a U.S. Securities and Exchange Commission (SEC) complaint requested “an order directing the defendants to pay civil monetary penalties.” However, it did not specify the penalty amount.

The civil lawsuit initiated by the SEC coincides with the indictment issued by U.S. federal prosecutors against Adani and several others.

On Wednesday, shares of 10 publicly traded Adani Group companies saw a rebound, regaining approximately $9 billion in market value. This recovery comes after the firms experienced a significant decline, losing up to $34 billion since the indictments, as of Tuesday’s market close.

Adani Green experienced a notable surge of 9% amidst the ongoing accusations; however, it remains down approximately $8 billion in overall value.

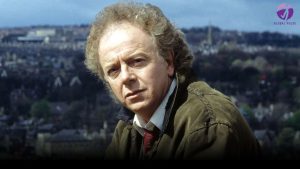

The recent indictments represent a significant setback for Gautam Adani, 62, and his conglomerate.

French oil giant TotalEnergies (TTEF.PA), which holds a 20% stake in Adani Green, has announced that it will cease further investments. The company also stated unaware of the U.S. bribery allegations involving Gautam Adani.

Kenya has officially terminated a procurement process valued at over $2 billion, which was anticipated to transfer control of its primary airport to the Adani Group.